Contents

kotrbiotech.com – Many applications of the loan funds online official circulating in the years 2021 to meet the various financial needs of the Buddy Smart. In the middle of the year 2021, many things happened which resulted in the economic activity is inhibited, one of them due to the Pandemic COVID-19.

Vaccination middle of the run, but unfortunately the economic activity can not run smoothly. As a result, quite a lot Mate Smart should manage your finances better, as well as re-arrange a long-term plan carefully.

If there is an urgent need that must be met, Pal Smart can choose to rely on 5 loan application online official here.

Understanding The Loan Application Online Official

The application, also known as the application of fintech lending. In Indonesia, the era of the emergence of fintech lending started in the year 2017. Until now, the presence of fintech lending is still coveted by people who need cash fast liquid for all the needs.

If compared to service loans from banks, fintech lending offers the ease of the form of the efficiency of the method of submission.

Pal Smart can get the loan funds just by accessing the application fintech lending by registering as a user of the application and apply for a loan.

In addition, the submission process and the disbursement of loans are available within 24 hours without being limited by the hours of work. Fintech lending is also generally offer free loan collateral.

Perhaps, for the enthusiasts of loan products, this sounds too good to be true, but the ceiling is available in the app fintech lending is provided by the service loans from banking companies.

On the other hand, fintech lending remains so craving for Pal Smart seek additional funds for various needs of the sudden.

All the advantages possessed by the fintech lending, unfortunately exploited by irresponsible parties to seek profit through deception with the lure of fast cash loans liquid without the app.

For that, Buddy Smart to be careful with the potential for such fraud. Trust the financial needs of the Buddy Smart through 5 recommendations fintech lending below.

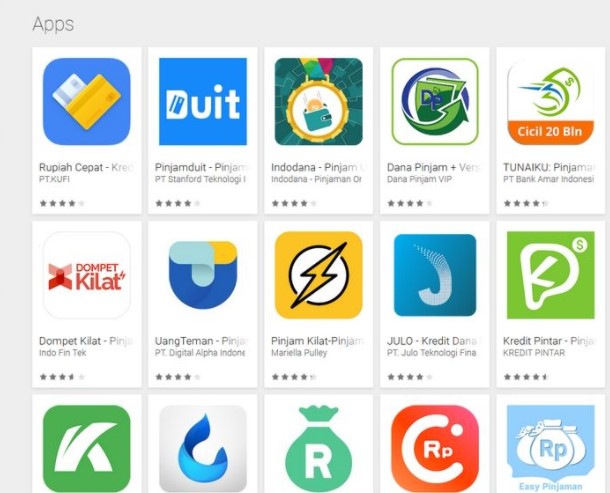

List Of Loan Official Online 2021

Fintech lending below has the status of official operating in Indonesia. Check out each of the benefits and business in accordance with the financial needs of the Buddy Smart.

Credit Smart

Credit Smart is the application of fintech lending without collateral that has been established since 2017 and currently has official status as a provider of loan funds online that have been registered and supervised by OJK.

With Credit Smart, the customer can simply include a photo ID as a condition of the loan application online legally required in the application. Pal Smart can apply for a loan of up to 20 million rupiah, depending on the credit score that is owned.

The process of filing the loan takes place in less than 3 minutes and funds will be disbursed within 1×24 hours after approval is received.

Credit application Smart available to be installed through the Google Play Store.

As a fintech lending trusted, Credit Smart provides a “book of special” for the user and the Buddy Smart who are interested to use application Credit Smart. The book, named as the Credit Smart Call Center FAQ.

Generally, the page contains a variety of questions collected by a team of Call Center Credit Smart that is often asked by the customer.

These pages are dedicated so that the customer can get answers to questions if you want to be filed with more quickly through the page.

IndoDana

IndoDana is a fintech lending service that provides cash loan and pay later, in one app. In service pay later. IndoDana has collaborated with various merchants in Indonesia, such as iStyle,Sepulsa, and others.

Service pay later, can be used if the customer wants to buy certain goods in installment, without having a credit card. Meanwhile, if the customer need cash fast liquid, the customer can choose the service of cash loan.

To enjoy the services provided in such applications, customers must have income at least in the amount of Rp 3.500.000,- per month.

Julo

Julo is a fintech lending authorized to operate in Indonesia. With Julo, customers can get a loan of up to 8 million dollars. Estimates of liquid funds to the account after the approval is for 2 x 24 hours.

If the customer pay the mortgage/pay off the loan earlier than the grace period, then will have the opportunity to earn cashback.

Koinworks

As an application of fintech lending, Koinworks provides 2 types of services under the category of users, i.e. business and personal.

For users for business purposes, the terms to apply for a loan is in the form of ID card of the director/owner of the company, company tax identification number, account statement for the last 3 months, and the financial statements.

Meanwhile, for user for personal needs, customers can apply for a loan through Koinworks to meet the requirements of the documents in the form of; KTP, NPWP when filing a loan at over 50 million, KK if already married, and mutations account for the last 3 months.

Not only apply for a loan, the customer Koinworks can also become an investor by registering as a lender in the application KoinWorks. Application Koinworks can be obtained through the App Store and Google Play Store.

Rupiah Quick

Rupiah Quick is one of the fintech lending which have been licensed and supervised by the FSA, so including fintech lending authorized to operate in Indonesia. The application offers the filing of a loan of up to 20 million with a tenor of 3 months. The customer can get the app Rupiah Quickly through the Google Play Store.

Buddy is Smart, that’s 5 recommendations the online loan application in Indonesia. When you need cash fast liquid, use Credit Smart is an online loan official in order to avoid fraud loan online illegal.