Kotrbiotech.com – Trading forex can be called done 24 hours nonstop, from Monday morning until Saturday morning (Western Indonesia Time). Hence, online forex trading can be done anywhere, anytime. However, there are actually certain times are better for trading, and there is also a time of less profitable for the trader.

In this article, we will review the background of hours the forex market is a 24-hour it as well as the right time for forex trading.

At that precise moment, there are more trading opportunities and profit potential is greater than other times. This knowledge must be owned by every trader, so don’t select the wrong time trading.

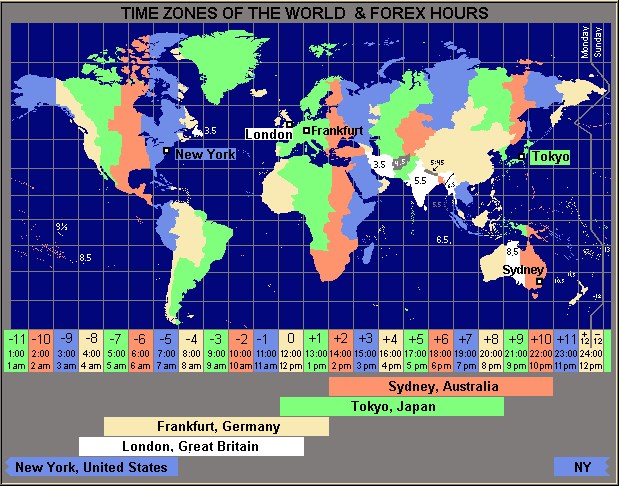

Market Hours For Forex

Forex trading takes place in a not centralized, and there is no exchange of a particular place of occurrence of the transaction. Network market forex woke up in the transactions in the interbank between financial institutions in different countries around the world. This is what causes the trading takes place 24 hours nonstop.

Starting from the commencement of working hours in Sydney, the financial centre of Australia, at 21:00 until 05:00 GMT. Financial centers in Asia following the open, especially Tokyo, at 23:00-07:00 GMT. After that, the relay continues into the region of Europe with the opening of the office door banks in London, Frankfurt, and others, for at 07:00-15:00 GMT. When the European market is almost the lid, turn the world financial center in New York.

Banks in the United States open at 12:00-20:00 GMT. Soon after American markets closed, banks in Australia are already starting work on a new day again. And so on, to create the cycle of the trade 24 hours from Monday to Saturday in the morning.

Forex market hours can be divided into four or three sessions. In the division of the four sessions, sessions, Sydney, Tokyo, London, and New York. While the division of the three sessions will consider the session Sydney and Tokyo as one of the Asian session, followed by the European and American session.

For a trader forex Indonesia, forex market hours based on GMT (Greenwhich Mean Time) needs to be converted into West Indonesia Time (WIB) by adding +7 hours. So, the Asian session starts at 04:00/05:00 WIB (dini hari), the European session starts at 14:00/15:00 PM, while the American session starts at 19:00/20:00 PM.

Why in the conversion included two hours of the opening of each session? Because some countries in Europe and the United States apply the DST (Daylight Saving Time) at the turn of the summer. DST resulted in the change of market hours forex for 1 hour, either on the hour of the opening and closing of each session, then turned to the original schedule after the summer passed. DST usually lasts between the months of March to October, with the start and end dates vary each year.

Trading sessions in the Forex Market

Among all of the trading session in the forex market today, each has its own characteristics. Here we go:

- Session Asia

There are four financial centers of the underlying trades in the Asian session, namely Sydney, Tokyo, Shanghai, Singapore, and Hong Kong. The scale of the total trading at a session of Sydney is very small, so the majority of new traders start active after Japanese office opened.

The release of economic data from Australia, Japan, and the PRC (three of the main economic) will profoundly affect the trade in Asian session. On the other hand, because Europe and America still sleeps, then the initial session is usually relatively quiet. The movement of the prices rarely exceed 100 pips in this session. Currency is the most crowded trades are usually Japanese Yen (JPY), Australian Dollar (AUD) , and New Zealand Dollar (NZD).

- Session Europe

There are many financial centers scattered across the European continent, but the most notable is London and Frankfurt. Data from the Uk and the countries of the European Union will be a market mover. All currency will be actively traded in the session, because the status of London as a world financial center since the middle ages.

However, pairs that contain the currency is Pound sterling (GBP) and Euro (EUR) usually experience changes the most. Trading during the European session very crowded, especially during the overlap (overlap) with the opening of the American session between the hours of 19:00 to 22:00 PM. Average price movement between 100-150 pips.

- Session America

New York has grown to become the financial center of the world in the modern era, almost replacing the dominance of London and clearly includes the scale larger than any city in the Asia-Australia. The release of economic data from the United States will be a market mover that is very significant in this session, and can affect the movement of all other currencies. Why is that? Because all pair mayor contain USD.

Not infrequently, the USD weakened on the Asian session (because at that time America was sleeping), but then turned higher on the American session. Traders should be aware of the occurrence of the reversal of the trend in this session with the discipline to apply Stop Loss. The price movement in this session can be very small or very large, with a range of movement between 50-150 pips.

The Right Time To Trading Forex

From the above discussion, we can conclude that the European and especially when the overlap of the two sessions (19:00-22:00 GMT) is the time of trading the best forex. The high price movements on the hour to open forex trading opportunities are very wide to allow the trader to harvest profit in a short time.

Even so, basically, each session can produce a considerable advantage if the trader to apply the appropriate strategy. Therefore, You can match the timing of the trading with the character of the risk and Your own trading style. How? Here are some examples:

- If You belong to a conservative trader (interest risk is low), then it can choose the trading between the Asian session to the beginning of the European session, then close the position before the start of the American session. The risk is relatively restrained, though trading opportunities are generally a little more.

- If You include the aggressive trader (interest risk is high), then can choose for trading since the beginning of the session until the end of the American session. Price movements can be very large in two of these sessions, especially when the overlap of the second session. So the risk is great, but the trading opportunities are also a lot more.

- If You belong to the trader users teknik Scalper, then can choose to trade only on the overlap of the session of the European/American alone between the hours of 19:00 to 22:00 PM. Why, the movement of prices in the Asian session on too slow. While the price movement on the American session too unpredictable and quite dangerous for the trader who just eyeing the difference in price just a little bit.

- If You include the News-Traders, or people who trade only when there is a release of economic data high-impact, then the mid-European session until mid-American could be so coveted. In the hours of this, a lot of economic data released. Of course, You also need to pay attention to forex calendar and make sure that the clock has been converted to a PM so don’t miss the news.

Thus some way to match the right time to trading forex with your taste and Your technique. Hopefully useful and help You increase profits up to double.